Why Is Tax Depreciation Different From Book Depreciation . Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Generally, accounting depreciation is used for financial. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. The main difference between accounting and tax depreciation is their purposes. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will.

from budgettaxdep.com.au

Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. The main difference between accounting and tax depreciation is their purposes. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Generally, accounting depreciation is used for financial. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will.

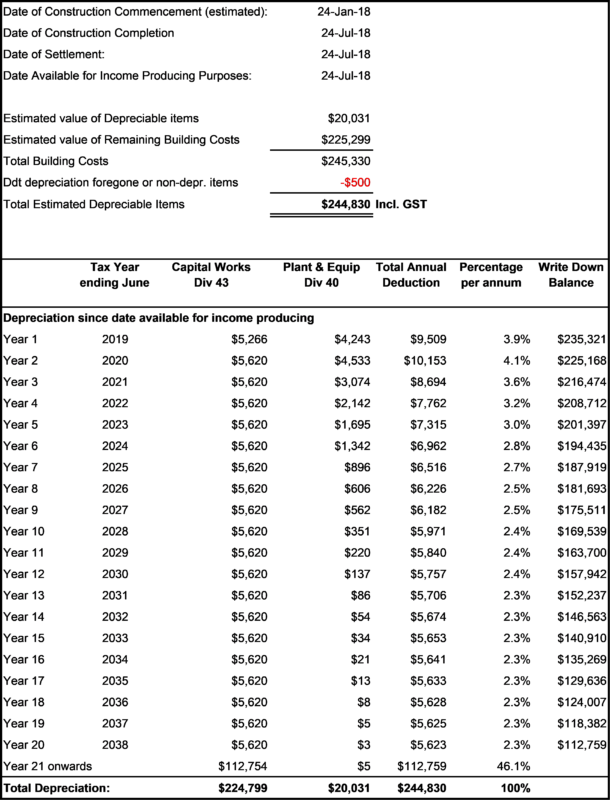

How much depreciation can i claim Budget Tax Depreciation

Why Is Tax Depreciation Different From Book Depreciation Generally, accounting depreciation is used for financial. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. The main difference between accounting and tax depreciation is their purposes. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Generally, accounting depreciation is used for financial.

From businessjargons.com

What is Depreciation? definition, objectives and methods Business Jargons Why Is Tax Depreciation Different From Book Depreciation Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. The main difference between accounting and tax depreciation is their purposes. Book depreciation, used in financial reporting, follows accounting. Why Is Tax Depreciation Different From Book Depreciation.

From www.teachoo.com

Depreciation as per Tax Assignment Depreciation Chart Why Is Tax Depreciation Different From Book Depreciation Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Tax. Why Is Tax Depreciation Different From Book Depreciation.

From www.differencebetween.net

Difference Between Tax Depreciation and Book Depreciation Difference Why Is Tax Depreciation Different From Book Depreciation Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Book depreciation refers to. Why Is Tax Depreciation Different From Book Depreciation.

From differencify.com

Difference Between Depreciation And Amortization(With Table) Differencify Why Is Tax Depreciation Different From Book Depreciation Generally, accounting depreciation is used for financial. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Generally, the difference between book depreciation and tax depreciation involves the “timing” of. Why Is Tax Depreciation Different From Book Depreciation.

From fabalabse.com

What is the journal entry for depreciation? Leia aqui What is Why Is Tax Depreciation Different From Book Depreciation Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. The main difference between accounting and tax depreciation is their purposes. Book depreciation influences how fixed assets appear. Why Is Tax Depreciation Different From Book Depreciation.

From www.mckaybusiness.com.au

WHY DO I NEED A TAX DEPRECIATION SCHEDULE? mckay business services Why Is Tax Depreciation Different From Book Depreciation The main difference between accounting and tax depreciation is their purposes. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Book depreciation refers to the systematic allocation of the cost of a tangible. Why Is Tax Depreciation Different From Book Depreciation.

From www.differencebetween.net

Difference Between Tax Depreciation and Book Depreciation Difference Why Is Tax Depreciation Different From Book Depreciation The main difference between accounting and tax depreciation is their purposes. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Generally, the difference between book depreciation and tax depreciation. Why Is Tax Depreciation Different From Book Depreciation.

From americanlegaljournal.com

What Is The Difference Between Book And Tax Depreciation? American Why Is Tax Depreciation Different From Book Depreciation The main difference between accounting and tax depreciation is their purposes. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Book depreciation influences how fixed assets appear. Why Is Tax Depreciation Different From Book Depreciation.

From einvestingforbeginners.com

Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends Why Is Tax Depreciation Different From Book Depreciation Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. The main difference between accounting and tax depreciation is their purposes. Generally, accounting depreciation is used for financial.. Why Is Tax Depreciation Different From Book Depreciation.

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Why Is Tax Depreciation Different From Book Depreciation Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period.. Why Is Tax Depreciation Different From Book Depreciation.

From napkinfinance.com

What is Depreciation? Napkin Finance has the answer for you! Why Is Tax Depreciation Different From Book Depreciation Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Generally, accounting depreciation is used for financial. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation. Why Is Tax Depreciation Different From Book Depreciation.

From www.slideserve.com

PPT Chapter 10 Depreciation PowerPoint Presentation, free download Why Is Tax Depreciation Different From Book Depreciation Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Tax. Why Is Tax Depreciation Different From Book Depreciation.

From efinancemanagement.com

Depreciation Definition, Types of its Methods with Impact on Net Why Is Tax Depreciation Different From Book Depreciation Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Tax depreciation is. Why Is Tax Depreciation Different From Book Depreciation.

From www.svtuition.org

Why is Depreciation Added to Net to Determine Cash Flow from Why Is Tax Depreciation Different From Book Depreciation Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Generally, accounting depreciation is used for financial. The main difference between accounting and tax depreciation is their purposes. Generally, the difference between. Why Is Tax Depreciation Different From Book Depreciation.

From www.differencebetween.net

Difference Between Tax Depreciation and Book Depreciation Difference Why Is Tax Depreciation Different From Book Depreciation The main difference between accounting and tax depreciation is their purposes. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Tax depreciation is more accelerated and takes into account changes in tax law, while book depreciation is not accelerated. Generally, accounting depreciation is used for financial. Generally, the difference between book depreciation. Why Is Tax Depreciation Different From Book Depreciation.

From taxrobot.com

Book vs Tax Depreciation The Real Difference TaxRobot Why Is Tax Depreciation Different From Book Depreciation Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. The main difference between accounting and tax depreciation is their purposes. Generally, accounting depreciation is used for financial. Book depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life for financial reporting purposes,.. Why Is Tax Depreciation Different From Book Depreciation.

From www.chegg.com

Solved Grand Corporation reported pretax book of Why Is Tax Depreciation Different From Book Depreciation Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Book depreciation, used in financial reporting, follows accounting principles to spread the cost of an asset over its useful life. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Generally, accounting. Why Is Tax Depreciation Different From Book Depreciation.

From kneelpost.blogspot.com

Depreciation For A Tax Paying Firm Kneelpost Why Is Tax Depreciation Different From Book Depreciation Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Book depreciation influences how fixed assets appear on financial statements, while tax depreciation affects your income tax. Generally, the difference between book depreciation and tax depreciation involves the “timing” of when the cost of an asset will. Book depreciation, used in financial. Why Is Tax Depreciation Different From Book Depreciation.